Spread Duration Times Spread . In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. The methodology, duration times spread (dts), has become the industry standard for measuring the credit volatility of a corporate bond. Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. This measure is calculated as a product of the market weight, spread duration,. Risk of credit securities called duration times spread (dts). Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross.

from www.financestrategists.com

The methodology, duration times spread (dts), has become the industry standard for measuring the credit volatility of a corporate bond. Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross. Risk of credit securities called duration times spread (dts). Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. This measure is calculated as a product of the market weight, spread duration,. In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond.

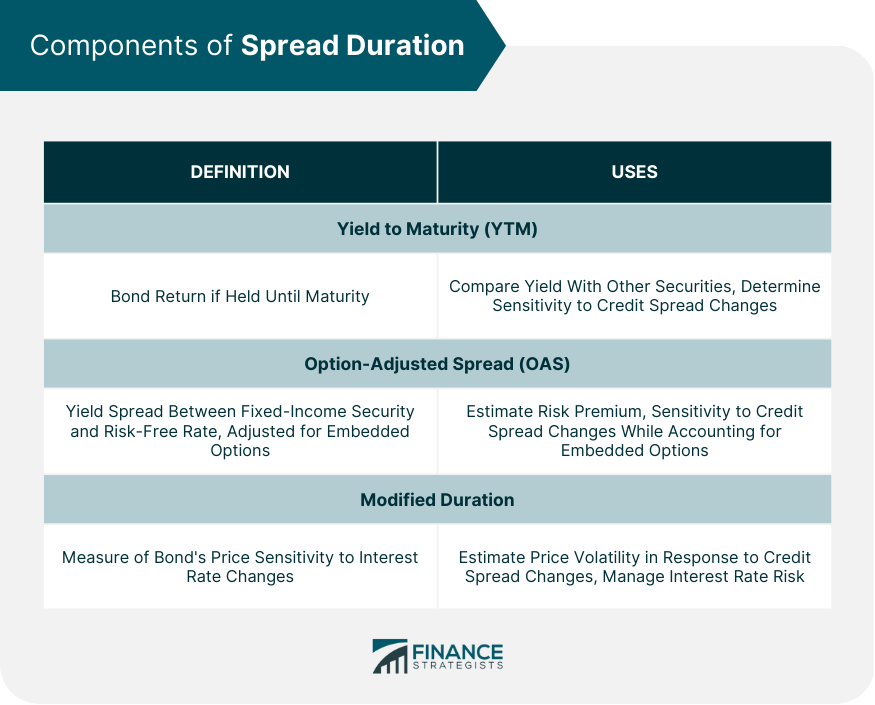

Spread Duration Definition, Components, & Applications

Spread Duration Times Spread Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. Risk of credit securities called duration times spread (dts). Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross. The methodology, duration times spread (dts), has become the industry standard for measuring the credit volatility of a corporate bond. This measure is calculated as a product of the market weight, spread duration,. Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond.

From transacted.io

Spread Duration Explained Transacted Spread Duration Times Spread Risk of credit securities called duration times spread (dts). Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross. This measure is calculated as a product of the market weight, spread duration,. The methodology, duration times spread (dts), has become the industry standard for measuring the. Spread Duration Times Spread.

From www.robeco.com

Duration Times Spread a measure of spread exposure in credit portfolios Spread Duration Times Spread In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). This measure is calculated as a product of the market weight, spread duration,. Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. The methodology, duration times spread (dts), has become the. Spread Duration Times Spread.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID Spread Duration Times Spread Risk of credit securities called duration times spread (dts). Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Duration times spread (dts) is a useful metric for measuring the credit. Spread Duration Times Spread.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Times Spread Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. Risk of credit securities called duration times spread (dts). Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. In this article, the authors introduce a new approach to measuring the risk of credit securities. Spread Duration Times Spread.

From econbrowser.com

Time Series on Term Spreads, Yield Curve Snapshots Econbrowser Spread Duration Times Spread The methodology, duration times spread (dts), has become the industry standard for measuring the credit volatility of a corporate bond. This measure is calculated as a product of the market weight, spread duration,. In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Dts measures the sensitivity of the. Spread Duration Times Spread.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID Spread Duration Times Spread Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross. Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. In this article, the authors introduce a new approach to measuring the risk of credit securities called duration. Spread Duration Times Spread.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Times Spread This measure is calculated as a product of the market weight, spread duration,. The methodology, duration times spread (dts), has become the industry standard for measuring the credit volatility of a corporate bond. Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. In this article, the authors introduce a new approach to. Spread Duration Times Spread.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Times Spread Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Risk of credit securities called duration times spread (dts). Duration times spread (dts) is the market standard method for measuring the credit. Spread Duration Times Spread.

From www.researchgate.net

(PDF) DTS (duration times spread) Spread Duration Times Spread This measure is calculated as a product of the market weight, spread duration,. Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross. Risk of credit securities called duration times spread (dts). Duration times spread (dts) is a useful metric for measuring the credit volatility of. Spread Duration Times Spread.

From www.investopedia.com

Duration and Convexity to Measure Bond Risk Spread Duration Times Spread Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. Risk of credit securities called duration times spread (dts). This measure is calculated as a product of the market weight, spread duration,. In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread. Spread Duration Times Spread.

From www.myespresso.com

What Is Ratio Spread and Ratio Back Spread in Options Trading Spread Duration Times Spread Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. Risk of credit securities called duration times spread (dts). In this article, the authors introduce a new approach to measuring the risk of credit securities. Spread Duration Times Spread.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation ID3950949 Spread Duration Times Spread In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross. The methodology, duration times spread (dts), has become the industry standard for measuring the credit. Spread Duration Times Spread.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Times Spread Risk of credit securities called duration times spread (dts). In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. Dts measures the sensitivity of the price of a bond to relative. Spread Duration Times Spread.

From analystprep.com

Optionadjusted Spreads CFA, FRM, and Actuarial Exams Study Notes Spread Duration Times Spread In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross. Duration times spread (dts) is the market standard method for measuring the credit volatility of. Spread Duration Times Spread.

From www.shiftingshares.com

What Is Spread Duration A Comprehensive Guide Shifting Shares Spread Duration Times Spread In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. This measure is calculated as a product of the market weight, spread duration,. The methodology, duration times spread (dts), has become the. Spread Duration Times Spread.

From www.pzacademy.com

spread duration有问必答品职教育 专注CFA ESG FRM CPA 考研等财经培训课程 Spread Duration Times Spread In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). Dts measures the sensitivity of the price of a bond to relative changes in spread, which are much more stable through time and cross. Duration times spread (dts) is the market standard method for measuring the credit volatility of. Spread Duration Times Spread.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID Spread Duration Times Spread Risk of credit securities called duration times spread (dts). Duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. This measure is calculated as a product of the market weight, spread duration,. In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread. Spread Duration Times Spread.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Times Spread In this article, the authors introduce a new approach to measuring the risk of credit securities called duration times spread (dts). The methodology, duration times spread (dts), has become the industry standard for measuring the credit volatility of a corporate bond. Risk of credit securities called duration times spread (dts). Dts measures the sensitivity of the price of a bond. Spread Duration Times Spread.